Overview of ST- Portfolio 2013

Courtesy of Portfolio Tracker from investmentmoats.com

Vested- 1 lot of ST Engineering @ $3.79. ( Strong fundamentals , solid blue chip with U.S dealings)

Divested - 5 lots of Freightlinks @0.105 ( now known as Vibrant Group ) loss of $180 . ( Apparently Freightlinks Express had renamed to Vibrant Group . Not a good sign in my own opinion as it has been in affiliation with one of the " Mega Church " in Singapore though interest of 6% per annual had been charged through borrowings and substantial shares of Suntec Reit might indirectly benefit the growth of Vibrant Group . Fundamentals of Freightlinks in 3QR were disappointing , and focus of shift towards from logistics to invesments and properties had prompt me to cut loss .)

Valuetronics might be the best investments so far i had made during august with price of less than 20 cents and cost on yield of 7.60% .

Personal Self Reflection

It has been a "tapered " year with news of tapering spreading like wild fire in 2013 and finalised in the upcoming months which we are going to enter in year 2014 .

"Taper Breakdown

The Fed’s purchases will be divided between $40 billion in Treasuries and $35 billion in mortgage bonds starting in January, down from $45 billion of government securities and $40 billion of the home-loan securities it’s buying each month now."http://www.bloomberg.com/news/2013-12-18/riskiest-retail-bond-spreads-widen-credit-swaps-hold-before-fed.html

I had finally achieved my target set of 10k portfolio ( All right this is very very small compared to many other peers here ) , well it's still an achievement for me .Peers in my bloglist had really taught me alot with aspect not just interms of investments but also life, philosophies ( Uncle CreateWealth , ASSI & SMOL ). Through blogging , it has enriched my knowledge .

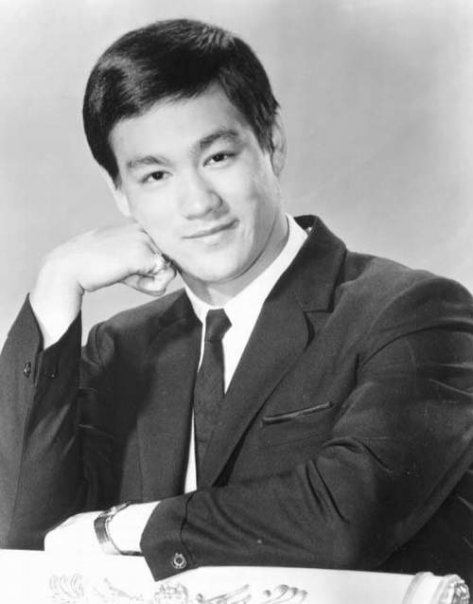

To end with a quote by Bruce Lee : “All knowledge leads to self-knowledge.”

― Bruce Lee, Tao of Jeet Kune Do

Last but not Least , Merry Christmas and Happy New year to All . Huat la !!